News & Resources

The latest updates from the Club

Featured article

Initially launched in 2020, in collaboration with the National Oceanography Centre (NOC), West are proud to be involved with the West P&I Science Bursary. This initiative continues to highlight their commitment to foster talent and innovation within the marine science and oceanography community.

Latest news

-

News 25 Apr, 2024Simon Parrott, Chief Underwriting Officer to retire in summer 2025

After 40 years of service at the Club, Simon Parrott will step down from his position of Chief Underwriting Officer (CUO) in the summer of 2025.

-

Loss Prevention 23 Apr, 2024Colombia - Drug Smuggling

The Club's Correspondent, A&A Multiprime Corp, has released its 2024 Colombia Drug Smuggling Report, offering a thorough analysis of the shifting challenges encountered by authorities and the maritime industry in their efforts to combat narcotics trafficking.

![Dean Crossley]() Dean CrossleyLoss Prevention Manager

Dean CrossleyLoss Prevention Manager -

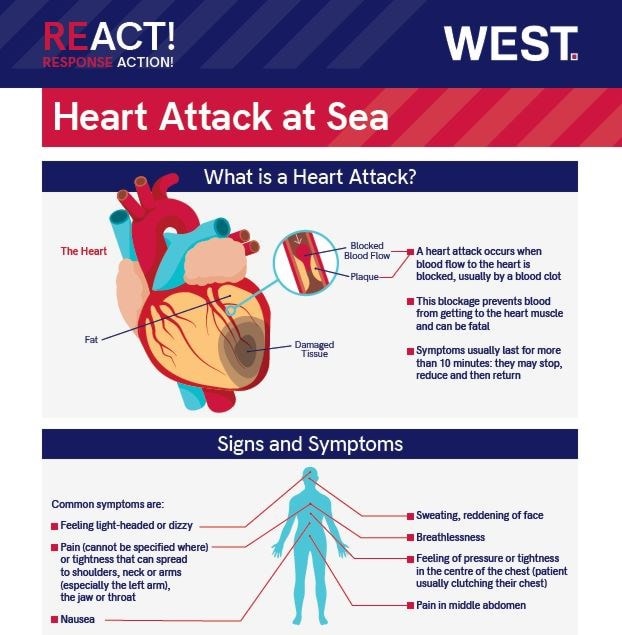

Loss Prevention 22 Apr, 2024New REACT! Loss Prevention Poster Published on Appendicitis

The Club has added a new poster to the REACT! Series. The poster was created because of an increasing incidence of cases whereby seafarers who had appendicitis misdiagnosed the symptoms, believing it to be purely abdominal pains.

![Emma Forbes-Gearey]() Emma Forbes-GeareyLoss Prevention Officer

Emma Forbes-GeareyLoss Prevention Officer

Notices to Members

Sanctions news

-

News 22 Apr, 2024Venezuela - re-imposition of U.S. sanctions

On 17 April 2024 OFAC issued General License 44A (GL44A) which permits the wind-down of oil and gas operations in Venezuela until 31 May 2024, including “the production, lifting, sale, and exportation of oil or gas from Venezuela, and provision of related goods and services” and transactions involving the state oil company PdVSA.

![Tony Paulson]() Tony PaulsonHead of Asia & Corporate Director

Tony PaulsonHead of Asia & Corporate Director -

News 12 Mar, 2024Russian sanctions – FHM Client Alert underlines designation risk

In reaction to a recent spate of new designations by the U.S. authorities against Russia, the Club’s U.S. lawyers Freehill, Hogan & Mahar (FHM) have produced a helpful Client Alert which summarises the actions taken.

![Tony Paulson]() Tony PaulsonHead of Asia & Corporate Director

Tony PaulsonHead of Asia & Corporate Director