Group Reinsurance Rates 2023/24

The arrangements for the renewal of the International Group General Excess of Loss (GXL) reinsurance contract and the Hydra reinsurance programme for 2023/24 have now been finalised. These include the Collective Overspill Cover; Excess War Risks P&I cover and MLC cover.

In contrast to recent years, 2022/23 has so far demonstrated a very benign Pool claims development, however, the conflict in Ukraine and the impact of Hurricane Ian on the wider reinsurance market, as well as back year claims deterioration on the Group contract have led to some challenging general reinsurance market conditions going into the 2023/24 renewal.

Nevertheless, the favourable claims development in the current year, together with the increases paid in 2022/23, has abled the International Group (IG) to renew its reinsurance programme for 2023/24 with only a small increase in rates for shipowners.

The main placement has been restructured into 3 layers and as a result, cover for COVID-19, Malicious Cyber and Pandemic risks has been expanded and is now free and unlimited for all claims up to US$ 650m xs US$ 100m, which covers almost all IG Clubs’ certified risks. Cover is aggregated above US$ 750m.

In addition, there continues to be the US$ 1 bn collective overspill placement.

The entire Group reinsurance placement, excess of US$ 100 million can be summarised as follows:

Layer 1 and Private Placements:

Layer 1 now provides cover for US$ 650 m excess USD 100m. 75% is placed with the open market with the 25% balance placed in 3 private market placements and is placed on a free and unlimited basis.

Layer 2 (US$ 750 m excess US$ 750 m) and Layer 3 (US$ 600 m excess of US$ 1.5 bn) are placed with the open market on a free and unlimited basis, except for risks in respect of malicious cyber, COVID-19 and Pandemic. Excess of US$ 750m there is up to US$1.35bn of annual aggregated cover in respect of these three risks across Layers 2 and 3.

Excess of that aggregated cover, the IG continues to pool any reinsurance shortfall, resulting in no change to shipowners’ cover.

Hydra Participation:

The Group’s Bermudan based reinsurance captive Hydra continues to provide cover within the pooled layers of the programme and a US$100 million AAD in the increased 75% market share of layer 1 of the GXL programme. Due to the increase in order for the open market layer to 75%, the value of the AAD has increased to US$ 107.1m for the 2023/24 policy year.

Other placements:

The Collective Overspill (US$ 1bn excess of US$ 2.1 bn) and ancillary covers are being renewed with premiums included within the overall rate per GT.

The Individual Club retention remains unchanged for the 2023/24 policy year at US$10 million, as does the structure of the Pool and the attachment point for the GXL programme.

MLC cover

The MLC market reinsurance cover is being renewed for 2023 at competitive market terms, with the premium included in the overall reinsurance rates charged to shipowners.

Excess War cover

The excess War P&I cover will be renewed for 2023/24 for a period of 12 months. Again, this will be included in the total rates charged to shipowners.

However, due to the ongoing conflict between Russia and Ukraine, the IG’s Excess War reinsurers require Territorial Exclusion language (consistent with exclusionary language already applied by reinsurers for Primary War P&I coverage) for vessels trading in these waters. The IG is negotiating availability of sub-limited cover for affected vessels, which remains an ongoing process. However, it appears available cover is likely to be at a significantly lower per-vessel limit than for the main Excess War placement limit of USD 500m.

We will provide details of this cover in due course.

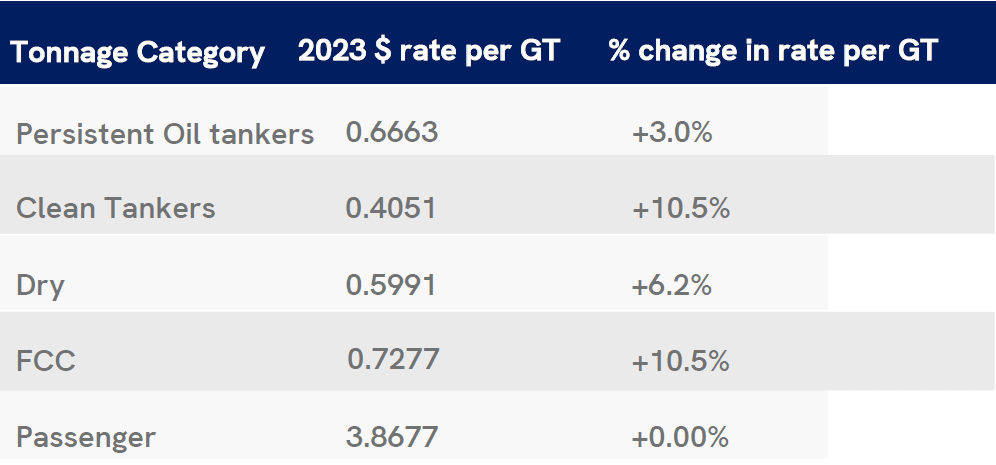

Reinsurance cost allocation 2023/24

As part of its annual analysis to ensure the fairness of cost allocation between different vessel types, the Reinsurance Committee (RIC) has also considered its current vessel categories.

The conclusions of the RIC are that there should be no change in the number of categories but that there should be some adjustments to the relative rate changes having regard to historical claims performance.

The 2023 rates are set out below:

As is customary, the 2022/23 Mutual call will be adjusted to reflect these rates and split evenly across all instalments.