Sulphur Cap 2020: Six Months Down Stream

The implementation of the global 0.50%m/m Sulphur cap on 1st January 2020 presented the industry with a new set of challenges, but these were rapidly overtaken by the impacts of the global Coronavirus pandemic.

Looking back to the build up to the 1st January 2020, the deadline for compliance with the MARPOL Annex VI 0.50% m/m sulphur cap requirements, no one within our industry would have imagined that in a few short weeks, our focus would be redirected in such an overwhelming way.

We as an industry had years to prepare ourselves for the 1st January deadline, whereas the Coronavirus did not afford any country, business sector, or individual such a luxury. The industry response was inevitable, swift, and decisive; maintain global trade and the movement of goods at all cost.

Sadly, this placed an enormous amount of pressure on the men and women who serve on board our vessels, who at times must have experienced even more isolation than usual when, due to global restrictions in movement, the date for their repatriation passed by and the opportunity for shore leave seemed to evaporate overnight. However, the challenges of having to deal with new and often unstable fuels, operational issues and unreliable supplies still had to be dealt with daily.

Background

Whether Members chose to burn low sulphur fuel as bunkers, use alternative fuels or Exhaust Gas Cleaning Systems (EGCS, i.e. scrubbers) approved under regulation 4 of MARPOL Annex VI, each method of reducing carbon emissions comes with its own set of unique challenges.

In his article Fuel Management and Operational Issues, Dmitry Kisil, a Senior Loss Prevention Officer at West, discussed just some of the operational concerns that were anticipated prior to the 1st January deadline.

Dmitry surmised that: “Composition of 2020 compliant fuel remains unknown but there are concerns that, even despite best efforts by fuel manufacturers and suppliers, technical problems brought about by certain characteristics of the new fuel oil are likely to be more frequent and more far reaching”.

The primary concerns were set out as:

Compatibility / Stability

Combustion / Ignition qualities

Cat fines

Unexpected or unusual fuel density vs viscosity compositions

Cold flow properties

Flash point

Low viscosity

Low sulphur content

Issues found in practice

Sediment and waxing

Experience in the last six months has shown however that certain supplies of very low sulphur fuels are prone to the formation of waxes, containing high levels of sediment and to issues around instability. Such fuels therefore need to be stored and handled very differently - including storage temperature and purification - from any pre-1st January supplies.

This may pose significant complications should tank heating either lack the ability to maintain the necessary high temperatures or the system develops a fault and goes off-line for a period. The subsequent formation of waxes and un-pumpable residues within the storage tanks and pipelines may require digging out by hand, which is both time consuming and costly.

Compatibility and instability

The compatibility and stability of VLSFO is also a concern as this also varies considerably from blend to blend. Compatibility relates to the co- mingling of incompatible bunkers and can be managed through tank segregation until compatibility can be confirmed through the testing process. Stability relates to each individual fuel blend being a stable product. A contributing factor underlying both is asphaltene stability. Asphaltenes are present in all crude petroleum residues but vary in content and characteristics depending on the crude oil’s origin. Asphaltenes are sensitive to changes in the aromaticity of the total fuel matrix, which changes when fuels are blended. Combining a residual stream with a paraffinic refinery stream (such as a low-sulphur distillate) to reach the 0.50% m/m sulphur limit would therefore increase the risk of the final blend being unstable.

In this new, low-sulphur era, the traditional lubricant indicator of base number (BN) which is used to quantify acid neutralisation capability will be only part of the equation. New refinery processes and fuel blend stocks used to produce VLSFO, as well as the expected incompatibility between VLSFO products, could lead to engine condition challenges that can only be tackled effectively with new lubricant additives.

The main function of marine engine cylinder lubricants is to provide lubricity that prevents damage to pistons and cylinder liners, although neutralisation is another important role, preventing excessive corrosion which can reduce the life of cylinder liners.

A corrosion, known as cold corrosion, can be found on large modern engines running on high sulphur fuel. Cold corrosion is the result of lower temperatures in ultra-long-stroke, large bore engines that cause acidic sulphur gases to condense on liner walls. To protect against this, lubricant additive packages for use with high-sulphur fuels in modern engines traditionally contain highly alkaline detergents. These provide greater acid neutralisation to protect from corrosion whilst also cleaning any deposits or cylinder wear residues, another crucial job for the lubricant.

Cylinder oils also need to have strong thermal management properties in order not to degrade at high temperatures within the combustion chamber. To meet these various roles and demands cylinder lubricants need the right combination of additives.

Fuel testing

Ian Crutchley, Veritas Petroleum Services describes their experiences in testing low Sulphur fuels from suppliers from around the world:

History has repeatedly taught us that issues with fuel quality can be expected whenever there is a significant change in sulphur legislation. The shift to VLSFO with maximum 0.5% Sulphur has been the most dramatic of these changes in recent years and whilst we have seen many of the aforementioned issues in this fuel grade, it is interesting to note that we also see a shift in quality within more conventional grades such as MGO and HFO.

By and large the industry has coped well with the transition, both on the supply and user sides, not least through the unprecedented levels of preparedness. However again, the transition has not been without some problems, and we have seen widespread fuel quality issues, both geographically and by nature.

The issues with certain parameters are summarised below, but one of the biggest challenges has been the sheer variation in VLSFO quality, from very “light” fuels, to more conventional looking intermediate blends. This variation is easily visible by assessing the viscosity of VLSFO in the market, which can typically range from 10cSt to 380cSt and higher. Vessels often need to adapt from one extreme to the next between bunker supplies, which creates a myriad of operational challenges.

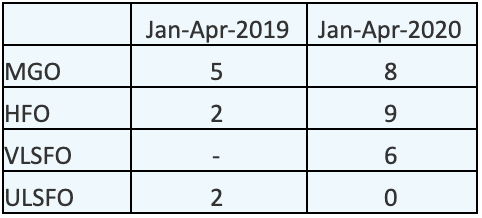

Bunker Alerts are issued to VPS clients, to make them aware whenever we see a trend of quality problems emerging from a certain port. Assessing the Bunker Alerts from this year, versus the same period last year, can act as one way to assess the impact of IMO2020.

Of the 2020 bunker alerts, the parameters involved have been:

MGO – Flash Point (6), Viscosity (2)

HFO – Flash Point (3), Density (3), Cat fines (1), Sediment (1), Potassium (1)

VLSFO – Sediment (4), Flash Point (1), Potassium (1)

The above indicates, not only do we see the emerging issues with VLSFO which we anticipated, but there also appears to be a knock-on effect on the quality of MGO and HFO. This is likely due to many factors, but probably in the main linked to the significant shift in fuel grade demand.

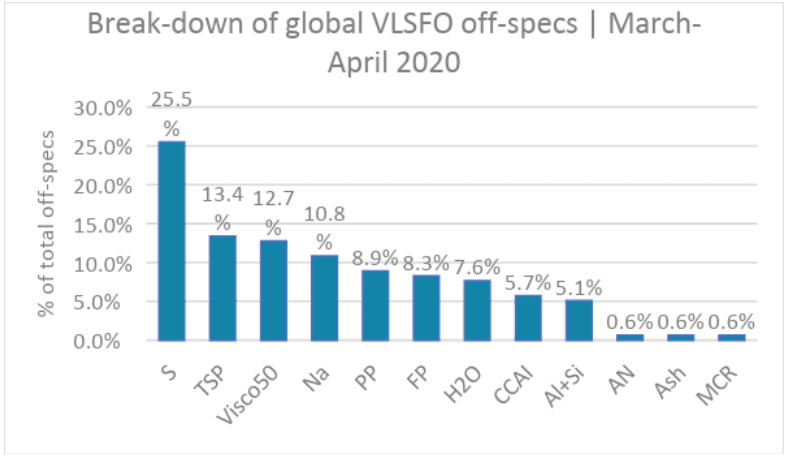

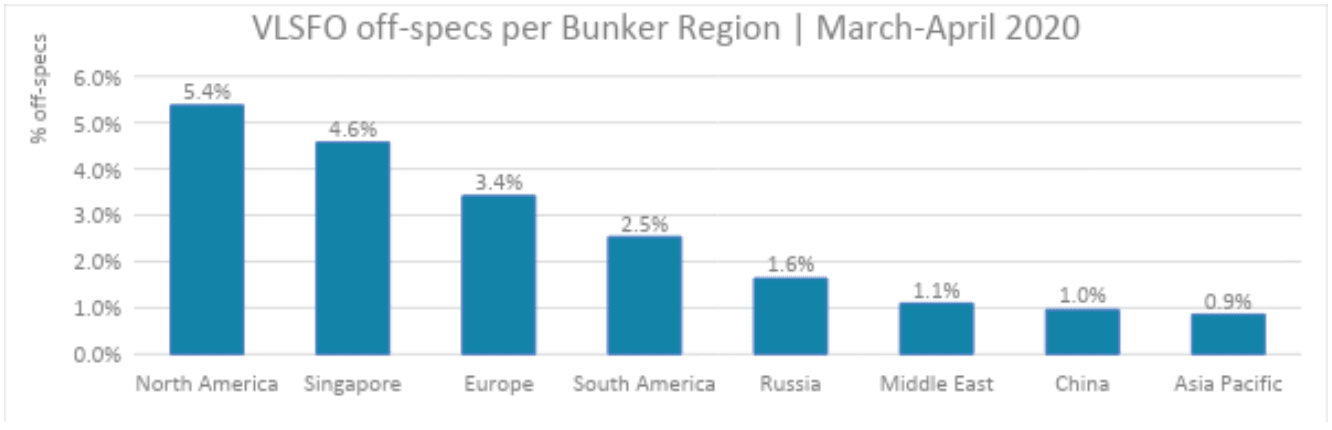

Of all the VLSFO’s tested by VPS during March and April 2020, a global off-spec rate of 3.9% has been seen and does appear to be improving.

From a compliance point of view, the most concerning area of off-spec is sulphur and flash point. Having said this, we have seen a gradual reduction of clear sulphur off specs (>0.53% Sulphur), down from 3% in January to just 0.3% in April.

Meanwhile from an operational perspective, TSP (stability), pour point and cat-fines levels (Al+Si) remain the most concerning.

Aside from the parameters routinely tested for ISO8217, there can be several other VLSFO challenges that can remain hidden, unless further testing is carried out. Many of these challenges manifest themselves in the form of severe sludging at the separators, and this can be caused by several things.

As mentioned, wax can be a problem in VLSFO, whereby its wax content is akin to MGO, meaning it can solidify at temperatures much higher than the pour point.

We also see very poor shelf life in many VLSFO’s, whereby when the manifold sample is tested for TSP as standard, it appears fine. But then the vessel reports problems, and it is only through additional testing that we can see the fuel has a very poor stability reserve.

Looking at VPS data from March to April 2020, the percentages of off-spec parameters can be seen below. A note of caution on this graph however, it can change dramatically every month and it’s also important to assess the nature of the off-specs involved. It is fair to say that certain parameters are of higher concern than others.

As discussed here, we do see a clear impact on the quality of all marine fuel grades, but what it is not clear is the impact that lower oil prices are having. The industry continues to adapt and to learn, but there is still a great deal of work to be done. Suppliers are striving to improve VLSFO quality which can be seen in the data, and meanwhile vessels continue to learn best practices for handling them.

From a user’s perspective, the following recommendations should be followed when procuring, handling, and using VLSFO:

- Obtain a certificate of quality COQ from the supplier upfront.

- Investigate systems available in the market, such as VPS’s “PortStats”, which allow a “live” view of global fuel quality by port and supplier. This allows informed procurement decisions based on actual tested parameters.

Ensure representative samples are taken and sent to the lab for analysis versus ISO8217. It is highly recommended to consider additional tests such as wax appearance temperature, GCMS and reserve stability number.

Wherever possible, avoid mixing VLSFO with any other grade of fuel, or comingling with any other VLSFO.

Based on the analysis report, ensure storage and handling temperatures of VLSFO are appropriate – hot enough to avoid wax problems, but not too hot to exacerbate stability issues.

Closely monitor all operational parameters from both the engines and fuel handling system.

Assess each piece of equipment within the fuel handling system, note its design limits and tolerances, and ensure it is capable to handle the wide range of VLSFO in the market. Many viscometers for example, may be optimised for use with 380cSt fuel, and may become unreliable where lower temperatures are required.

By assessing cylinder scrape down analysis, ensure suitable grade and feed rate of cylinder oil is in use.

Lube oil considerations

Harriet Brice, Technology Manager at Lubrizol said: “It is clear that some features of VLSFOs introduce variability that will require lubricants with improved deposit handling performance… Using a more robust lubricant will help to reduce the impact to the engine of this variability.”

High BN detergents have dominated cylinder lubricant formulations as they deliver the acid neutralisation needed for HFO and help to keep the high temperature surfaces of the engine clean of deposits.

Reducing these high BN detergents for the lower neutralisation needs of 0.50%S fuels without rebalancing the formulation with extra deposit control additives would severely impact on the lubricant cleanliness performance.”

Lubrizol have published a detailed paper on this topic called “The VLSFO Challenge: Looking Deeper for Lubricant Performance”. In the paper, they discuss the important role that cylinder lube oil plays, the impact VLSFO has on traditional lube oil specifications and the need for a new generation of additives specifically developed to counter the negative effects in this new low Sulphur era. The Lubrizol study can be read here VPS White Paper Engine Protection for VLSFOs.

An investigation carried out by Veritas Petroleum Services (VPS) has identified over 40 vessels suffering from major engine damage since starting to bunker Very Low Sulphur Fuel Oil (VLSFO).The study found that calcium compounds were being deposited on the piston crown despite the vessels using the engine makers recommended 40BN (base number) engine cylinder lube oil.

VPS said: “The investigation identified that the reserve BN in the cylinder oil was not being utilised to neutralise the acids formed during the fuel combustion process. This resulted in calcium compounds being deposited on the piston top, which became hard and abrasive causing liner wear, liner scuffing and piston ring breakage resulting in serious operational issues,”

“The investigation also identified excessive liner wear on the cylinder units of two‐stroke engines since the introduction of VLSFOs. This damage to engine components has a detrimental impact on vessel operability and has been investigated in this report”.

“Engines affected were not limited to any specific Original Equipment Manufacturer (OEM) but from many of the major engine makers in the marine industry. In all cases VLSFO fuel quality was tested and found to be acceptable and the original cylinder oil that was used was 40BN grade supplied from most of the key suppliers.”

Oil price impacts

The International Energy Agency (IEA) had forecast a collapse of oil demand at the start of the Coronavirus outbreak in early 2020 and a further decrease by around 23.1 m/bpd to mid-2020.

The IEA have stated that: “The supply-demand imbalance leads to a steep uptick in crude oil stockpiling, which will continue to drag on the oil product prices in the months to come. The recovery in the second half of 2020 is projected to be gradual, as economies come out of containment and activity levels rise, but demand is not expected to reach pre-crisis levels before the end of the year”.

Despite the OPEC+ production cuts intended to promote price stability whilst the market recovers from the Coronavirus pandemic, these demand shocks have continued to have assert downward pressure on the oil (and therefore bunker) prices.

This may well benefit the shipping industry, by encouraging trade growth on the back of low bunker prices and increase charterer confidence, but vigilance must be exercised by shipowners. History has shown that increased commercial pressure on bunker suppliers may result in unregulated cutter stock being added to marine fuels, with potentially catastrophic effects on main and auxiliary machinery.

Beware of non-compliant fuels

From 1st March 2020 non-compliant fuel can only be carried for use on board, where the vessel is fitted with a scrubber. In instances where compliant (0.50% m/m) fuel cannot be obtained, a Fuel Oil Non-Availability Report (FONAR) must be submitted to the flag State and the Competent Authority in the next port of call. Furthermore, if the vessel is trading within an Emission Control Area (ECA), the maximum sulphur content is limited to 0.10% m/m. Failure to comply may result in costly Port State Control (PSC) deficiencies being raised, detentions and potentially fines being imposed.

In our article “Issues arising from non-compliance”, Nicola Cox, Head of Defence at West, used a Q&A format to discuss a number of issues that Members may encounter if faced with a lack of compliant fuel and have no other option than to burn non-compliant fuel.

Industry reflections

Ms Caroline Yang, Chief Executive, Hong Lam Marine (Singapore-based bunker suppliers and West Member) gives her account of the first six months of the IMO 2020 Sulphur Cap compliance:

In Singapore, with the detailed preparation in the last 6 months before 1st January 2020, the IMO 2020 Sulphur Cap effective 1st January 2020 was almost a non-event.

There was availability of compliant fuel and bunker tankers to support the demand. In Q1 of 2020, only 2 ships were found to have non-compliant fuel on board. It does show that the worldwide shipping industry was prepared. The Covid-19 outbreak has however caused serious disruptions to the supply and demand and the bunker volumes will be affected.

Singapore as a top bunkering hub with its reputation for transparency and efficiency is still doing well compared with the same period of last year, but the next few months will be a challenge.

As for the collapse in oil prices, this benefits ship owners assisting in their opex. Will oil prices bounce back? It has recovered somewhat, but a bounce back? Some say that we will see it being lower for longer, and some say that we will see US$70 same time next year.

Slawomir Pyz, SMT Shipping Poland provides his operational insight into the issues they have found:

We have noticed that some suppliers used unfamiliar blends to achieve lower sulphur levels while continuing to include residual streams. Total Sediment by hot filtration is the ISO8217 method for stability in marine residual fuels, it essentially involves stressing a fuel either chemically (TSA) or by heating (TSP) before filtering it through a fine filter, and measuring the residue remaining to give an indication of a fuel’s ability to remain stable.

Long chain paraffins present in fractions of VLSFO are responsible for wax formation in fuels. These waxy elements must be heated to prevent them transforming into large waxy crystals that drop out of solution, blocking tanks, filters, and purifiers at low temperatures.

Fuel test laboratories have recognized this issue and developed the Wax Appearance Temperature (WAT) test method (amongst others) to establish at what temperature VLSFO starts to produce wax crystals, a “cloud point”.

The advice for preventing wax drop out is to maintain temperatures 15°C above Pour Point (PP) during handling and separation. We have heating capabilities on board, although we still experience wax blockages at purifiers as the wax is removed during separation.

In conclusion, we are seeing fouling in purifiers due to distillate aging when recommended separation temperatures are used, wax drop out when temperatures are too low, asphaltene drop out due to instability in fuel and distillate sludge from oxidisation.

VLSFO fuels needs a lot of energy and knowledge from the ship staff before and during usage, but still creates a lot of problems.

Fred Finger, Vice President, Head of Operations at American Roll On Roll Off Carrier provides a summary of their experiences during the first 6 months of the IMO 2020 Sulphur Cap compliance:

Both our vessels and our shore-side staff spent a significant amount of time and effort preparing for the January changeover from 3.5% HFO to 0.5% VLSFO. However, despite all the preparation we still experienced some growing pains during the transition.

While the overall operation probably went as well as could be expected, we did experience a few potentially serious operational issues following the initial loadouts. These issues primarily involved either excessive build-up of sediment and sludge in the purifiers or the ship making incorrect fuel temperature adjustments related to the viscosity of the fuel.

The good news is that since we have worked through the initial loads, the number of issues involving LSFO have gone down dramatically. This is likely due to crew familiarization with the VLSFO operation as well as adjustments made by the suppliers following feedback owners and operators.

The majority of our fleet operates in a trade that keeps them inside ECA zones for about 50% of the time. As a result, these vessels are switching between fuel types about every two weeks. In a service such as this, proficiency in managing the changeover between MGO and VLSO and understanding the risks associated with it becomes absolutely critical.

Going forward, we anticipate that two of our biggest challenges will be proper management of tankage segregation and having crews that are properly trained with regards to the characteristics of the fuels they load and based on these characteristics, how to make the necessary operational adjustments to ensure a safe reliable operation.

A surveyor’s point of view

Ben Harper-Longbone, Senior Marine Engineer & Surveyor, Crawford Marine gives his account of their experiences to date in this low sulphur fuel era:

“Whilst the shipping world continues to trade under the considerable strain of not only IMO 2020 but also COVID-19 which appeared at the same time, onboard Marine Engineers have been required to deal with a torrent of issues with limited support.

Issues such as waxing of the fuel systems due to instability of the VLSFO or its incompatibility during changeover to ULSFO within Emission Controlled Areas, to excessive and unusual wear patterns of cylinder liners, pistons and associated equipment due to abrasion and cold corrosion continue to occur.

Whilst the damage inspected can appear similar to previously experienced issues during the height of HFO usage such as cold corrosion, VLSFO investigations are progressively leading in various directions from cylinder oil application, chemical compatibility with cylinder oils, as well as the alkalinity of the low BN cylinder oils, whether over neutralising acids or under neutralising due to other physical impediments.

Whilst causation of recent damages is still being investigated in association with VLSFO usage, it is paramount that we continue to remember the lessons learnt from our past, in particular that catalytic fines remain the biggest cause of abrasion wear rates in all types of engines and associated marine equipment.

With fuel analysis returning in-spec values of Al+Si of 60mg/kg (ISO:8217-2017), albeit understanding that only a maximum of 15mg/kg is permitted at entry into the engine, what we ask of onboard fuel oil processing systems, equipment and Marine Engineers has never been so demanding. This despite that fuel is rarely continuously sampled and monitored post pre-engine filtration and entry into the engine, to determine whether the onboard fuel processing system and equipment is working as efficiently as designed and/or operated.

The marine engineering world is in a period of learning whilst also fire-fighting the many engine failures currently being experienced, all having to revert to basic principles rather than their experience of the relatively unknown VLSFO, with insurers often required to pick up the tab”.

West of England’s perspective

Commenting on the incidence of disputes related to the new Sulphur regulations, Nicola Cox noted:

“As at the middle of June 2020, the West of England has seen a small number (approximately 20) MARPOL Annex VI-related Defence incidents. This represents approximately 2% of the Club’s Defence claims in a policy year. The claims outlook for Defence in respect of these incidents is mainly benign, with several of the incidents (received as far back as August 2019) being queries and requests for advice relating to the implementation of MARPOL Annex VI, rather than disputes. However, the Club does have a handful of disputes relating to the retrofitting of scrubbers on board and these are likely to prove more costly”.

Accreditations

The Club would like to thank the following for their contribution to this article:

Mr Ian Crutchley of Veritas Petroleum Services

Mr Ben Harper-Longbone, Senior Marine Engineer & Surveyor of Crawford Marine

And West Members:

Ms Caroline Yang, Chief Executive at Hong Lam

Mr Fred Finger, Vice President, Head of Operations at American Roll On Roll Off Carrier

Mr Slawomir Pyz at SMT Shipping Poland s.p. z.o.o

A copy of the Veritas Petroleum Services study, Engine Protection for VLSFO can be read here VPS White Paper Engine Protection for VLSFOs .

A copy of the Lubrizol study, The VLSFO Challenge: Looking Deeper for Lubricant Performance can be read here Lubrizol: The VLSFO Challenge - Looking Deeper For Lubricant Performance .

The Clubs Sulphur Cap 2020 platform in our News and Insights section contains other resources and material that Members may find useful.