Charterers & Traders

The West of England was one of the first P&I Clubs to offer a tailor-made liability insurance product for Charterers & Traders, which has continually been improved and adapted over the years to offer a wide scope of cover, whilst at the same time maintaining the high-level service capability for which the West of England is renowned.

In addition to P&I liabilities and Defence risks traditionally covered by the Club, our CCC product can be tailored to include;

- Loss or damage to hull, including liability to pay freight and hire arising out of such loss or damage

- The Charterer’s contributions to general average, salvage and special charges

- Loss or damage to fuel stores and supplies

- Cargo owner’s cover for pollution and/or legal liabilities

- War and strikes risks

- Costs of removing off-specification bunkers likely to cause damage to the vessel’s engines and machinery

- Primary delay cover

- Extended contractual liability cover

- Extended cargo cover – extending the rights of the cargo interestsbeyond those found in the Hague-Visby Rules

- Specialist Operations – such as construction vessels or oil pollution response vessels

- Defence traders extension – Defence-type risks arising under a sales form in relation to an entered vessel

- Charterer’s loss of freight – where the vessel is a total loss

Why West Charterers?

- Cover placed as a single package with one policy

- Single aggregate limit per incident

- No need to declare hull values

- Variable limits of liability available

- Ability to tailor the product to specific heads of cover which best accommodate a Member’s needs

- Unified claims handling strategy for all the above heads of cover

- Dedicated Charterers & Traders team

- Wide book of Charterers & Traders

- Quick response time

- Contract review with insurance solutions

-

Charterers & Traders proposal form Excel (15 KB)

Scope of cover

The cover is provided to the Member in their capacity as Charterer of the insured vessel and the details of the heads of cover are as follows:

Liability Risks

1. P&I risks

The Charterer Member is insured in their capacity as Charterer for the same P&I risks as a shipowner and, furthermore, is also insured for his liabilities as Charterer to indemnify the Owner or Disponent Owner of the insured vessel in respect of such P&I risks.

In addition to the above risks, cover can be tailored to include any of the following additional risks and liabilities:

2. Damage to hull

The cover offered essentially reincorporates risks excluded under Rule 16 of the Club Rules so that a Charterer is covered for his liability to pay damages to the Owner or Disponent Owner of the insured vessel in respect of loss of or damage to the vessel and/or loss of use of the vessel arising from such damage. The cover under this section has been extended to include a Charterer’s liability for the payment of freight or charter hire as a result of such a loss of or damage to the vessel.

3. Contribution to general average, salvage and special charges

This head of cover is not normally available under conventional Charterers liability policies. It protects the Charterer against the risk of having to contribute to general average, salvage and special charges in respect of the Charterer’s own property at risk in the maritime venture. That property would include, for example, bunkers, containers and any other material or equipment (other than cargo) which the Charterer has placed on board the insured vessel.

4. Fuel stores and supplies

This head of cover is principally designed to cover Charterers against the risk of loss of or damage to their bunkers placed on board the insured vessel. Unlike many conventional policies which provide bunkers cover on terms which are similar to restricted forms of cargo insurance, the Club cover is essentially an all-risk cover with limited exclusions of: ordinary loss in weight or volume, natural degradation, inherent vice, delay and politically motivated or terrorist acts.

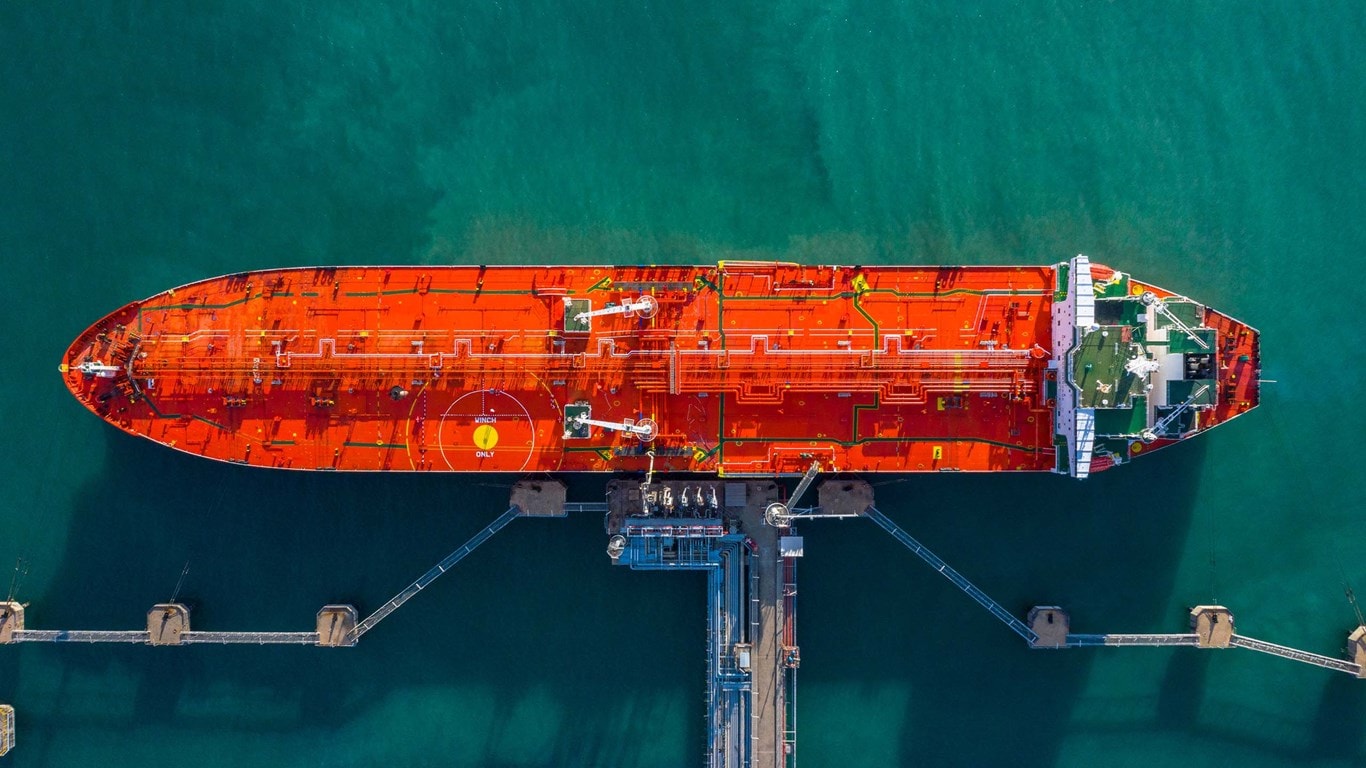

5. Cargo owner’s pollution and/or legal liability

This extension allows the Charterer to be covered for any pollution or other liability within the Rules of the Association they may incur at a time when they and/or an associated company owned all or part of the cargo carried on board the insured vessel. This head of cover may be of particular interest to Charterers in the oil trade.

6. War and strikes cover

This separate extension of cover essentially reincorporates the war risks excluded under Rule 14 of the Club’s Rules, although it remains subject to the usual exclusions such as, for example, liabilities arising out of an outbreak of war between any of the five historic nuclear powers and capture or arrest by the Government or any authority in the country in which the vessel is registered.

7. Extraordinary costs incurred in the removal and replacement of bunkers

This extension is designed to cover Charterers for the extraordinary costs incurred in removing and replacing off-spec bunkers supplied by the Charterer which potentially could be harmful to the vessel’s machinery. Cover may also extend to the cleaning of the vessel’s engines, tanks or pipelines and disposal of the off-spec bunkers. It should be noted that this cover does not extend to the value of the off-spec bunkers or the replacement costs and is only engaged where bunkers create a risk of machinery damage and not merely a risk of regulatory non-compliance.

P&I Limit of Liability

The standard limit of cover provided in respect of P&I risks is US$ 500 million in the aggregate in respect of any one incident any one vessel. However, War Risks, if purchased, has a sub-limit of $100 million dollars in respect of any one incident. The additional cover for “Fuel Stores and Supplies” is also subject to a separate sub-limit, to be agreed, depending on the tonnage and type of vessels chartered. Lower or higher overall limits of cover of up to US$ 1 billion are also available if required. This can be discussed with the Underwriter at the time of commencing cover.

Who can be insured?

It is suitable for:

- Time Charterers

- Voyage Charterers

- Charterers under contract of affreightment

- Space or Slot Charterers

The product is suitable for most types of trade, whether it be liner operations, oil or other bulk products trading or conventional tramp market chartering.

Charterers need not purchase all the heads of cover offered but can select those heads of cover which best accommodate their needs.

Charterers by demise or bareboat Charterers, whose risks are more closely aligned with those of shipowners, would be best advised to insure their risks under a conventional Owners P&I entry, rather than under the Charterers Comprehensive Cover, since an Owner’s P&I entry will more closely suit their needs.

Claims Examples

Fire onboard, wet damage and hull damage are all complex claims resolved by West. Click on the dropdowns below to see how our Claims teams found solutions for our Members.

The Club arranged for surveyor attendance to investigate. Owners’ Club put up security and settled the claim. Owners claimed an indemnity from the Member for the cargo claim and off-hire for lost time.

The charterparty apportioned liability to the Member for all cargo claims in the absence of unseaworthiness and/or ingress of sea water. Owners alleged that the charterers were responsible for the damage due to

stowage, shortage and condensation.

The evidence suggested some of the damage was potentially attributable to sea water ingress and crew negligence. The Club successfully negotiated a settlement representing only 26% of the total value of the owners’ settled cargo claim.

A ro-ro passenger ferry was time chartered by the Member. A fire started inside one of decks during a voyage from Greece to Italy. The ferry carried passengers, cars and trucks laden with cargo. The vessel became incapacitated from the fire; passengers had to be evacuated. Unfortunately, during the incident there were fatalities and injuries to some of the passengers. The vessel was towed to Italy.

The Member had issued passenger tickets and truck tickets as contractual carrier. Charterers’ liability from the incident was complex and had several heads of claim: fatal passenger claims, non-fatal passenger claims, burnt out vehicles, damaged cargo, charterers’ crew claims, charterers’ property claims, salved bunkers, claimed loss of vessel, disposal costs and significant legal costs.

The Club worked with the Member’s operational team, external legal and technical experts to mobilise a response strategy. The Club and Members created a centralised system monitoring incoming claims and cataloguing important data. Claims in multiple jurisdictions were presented against charterers. The Club and legal counsel assisted to negotiate early settlement where appropriate and possible, or defended those claims

in litigation.

The Club adopted a coordinated approach with the owners’ Club to maintain a consistent approach in claims handling and settlement.

A Member time chartered a 40,000 GWT bulk carrier. Owners alleged that bunkers stemmed by the Member in Cristobal did not meet the ISO 8217:2005 specifications. The supplier was notified and kept appraised of the situation.

Head owners’ precautionary analysis of manifold samples identified the presence of organic compounds which Owners averred rendered the fuel off-specification. Charterers’ independent analysis of the supplier’s sample reported the presence of chemical contaminants.

Head owners refused to burn the bunkers and deviated the vessel to stem additional bunkers at a higher price than the Cristobal stem. A claim going down the charter chain was presented for the price differential and a demand that charterers remove the bunkers.

The Club obtained expert advice to explore the suitability of burning the bunkers. To allay owners’ concerns and to assist with the smooth cooperation of the parties involved, the Club promptly provided security on behalf of Members for bunker removal costs. Charterers’ expert determined the bunkers were safe to burn. The Club was actively engaged with owner’s club and with the assistance of experts, a protocol for the test burn was agreed with owners. Following a successful trial head owners agreed to burn the bunkers.

A bulk carrier was time chartered by the Member for the carriage of grain from Louisiana to Italy. During loading operations, there was contact damage by the loader chute to one of the hatch covers.

Investigations concluded liability was firmly on the part of stevedores, who under the usual terms of the charterparty were at charterers’ risk and responsibility. The damage did not affect the water tightness of the hatch cover and the vessel completed her voyage without delay. The nature of the damage and positioning of the hatch cover required complex repair work to meet Class approval. These repairs were deferred until after the vessel had been redelivered; repairing in the next two calling ports would have come at considerable expense.

Due to careful time management, the repairs were completed in stages during a call to South Africa, at a reasonable cost despite a tight time frame, without adversely impacting commercial operations or delaying subsequent voyages. The Club settled the repair costs on behalf of the Member, before approaching the stevedore company for an indemnity. The Club successfully negotiated a 100% recovery of the repair costs for

the Member without commencing suit or incurring legal costs in the US.

A Member was the head voyage charterer of a 40,000 GWT bulk carrier. The Member sub chartered the vessel out to sub voyage charterers to carry coal cargo from Russia to India. The charterparties contained safe port and safe berth warranties. Head Owners alleged floating ice at one of the load ports seriously damaged the vessel’s propellor blades.

Head owners declared general average; the vessel was removed for permanent repairs. She later completed the voyage. Disponent owners as time charterers were responsible for GA contributions towards their bunkers onboard.

Disponent owners presented an unsafe port claim against the Member for hull damage and related losses, which was passed down the chain. The Club and legal counsel made an early assessment of the claims. The Club directed the Member’s legal counsel to bring the multiple parties together to see if the matter might be resolved during the preliminary stages of the dispute. An early commercial deal was agreed and the Member avoided incurring further procedural costs.

Download the brochure:

-

Charterers & Traders PDF (784.3 KB)

Why West of England?

The West of England is a leading insurance provider to the global shipping industry, combining financial strength with outstanding service to help its Members meet the continually evolving liability environment in which shipowners, operators and charterers operate.

We also safeguard and promote our Members’ interests in many other areas of their business. We believe that protection for our Members is as important as the indemnity insurance we offer. To provide both we are responsive to our Members’ needs and proactive in looking after their interests, enabling them to more easily achieve their business goals.

Our strengths

- An international Club with a global membership

- A worldwide office network providing dedicated underwriting, claims and loss prevention service to our Members

- A Member of the International Group of P&I Clubs

- Access to WestNet: Our digital platform for live records & claim details

- Access to Neptune: Our innovative data portal containing geographical and bunker data to help with voyage planning

- Access to training and bespoke seminars